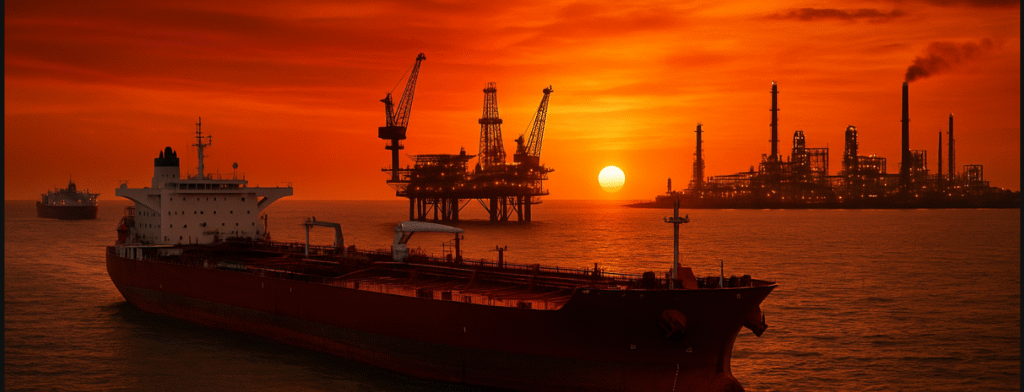

The U.S. Runs on Heavy Barrels

United States wells now pump 13.4 million barrels of oil each day. Tankers still unload close to 8 million barrels daily at American docks. Chemistry, not volume, explains the gap. Shale fields yield light, sweet crude, yet about 70 percent of Gulf Coast refining capacity needs heavier, sulfur-rich grades. Ninety percent of imports match that recipe.

The Supplier Triangle

- Canada ships roughly 4 million barrels a day to the United States, equal to 60 percent of all imports. New ten-percent tariffs imposed in March 2025 strain that flow.

- Venezuela delivered more than 3 million barrels per day in 2000. Output slipped to 735 000 barrels in 2023, and Washington cancelled Chevron’s waiver in early 2025.

- Iran produces about 3.28 million barrels a day and exports up to 1.8 million, almost all of it to China. Analysts reckon output could hit 3.8 million if sanctions vanish.

With Canadian ties tense and Venezuelan fields in decline, Iranian barrels now anchor the heavy slate that U.S. refiners crave.

Hormuz: A Narrow Lifeline

Roughly one-fifth of global oil and liquefied gas sails through the Strait of Hormuz each day. The channel narrows to about 33 kilometres, with two-kilometre traffic lanes in each direction. Iran borders the north shore, Oman the south, and a strip of international water splits the middle. The United States keeps its Fifth Fleet in Bahrain to keep the route open.

Parliament Vote Versus Real Power

On 22 June the Iranian parliament urged a closure of Hormuz. The Supreme National Security Council, chaired by Ayatollah Ali Khamenei, must still sign off. Until that body acts, shipping rules stay unchanged. Closing the strait would breach the transit-passage rule in the U.N. Law of the Sea and invite confrontation with Oman, Gulf Arab exporters, and the U.S. Navy.

Why a Blockade Hurts Tehran First

Iran pushes about 85 percent of its own crude through Hormuz, half bound for China. A shut-in would erase Tehran’s main source of hard currency and block vital imports that follow the same route. Past drills proved Iran can mine the waterway or fire anti-ship missiles, yet any real stoppage would spark a military response that Tehran cannot afford.

China’s Buffer Has Limits

Chinese tanks hold near 1.1 billion barrels when strategic and commercial sites are counted together. The country burns roughly 15 million barrels each day, so stocks equal about 70 days of cover. Recent satellite data show draws of 20 million barrels since late May. Inventories can absorb a short shock, yet steady refinery runs will drain them in two to three months.

Can China avoid the spot market if Iranian barrels vanish? Only for a while. Once stocks dip below comfort levels Beijing will bid for heavy sour grades from the Middle East and Latin America, lifting prices for Maya, Basrah Heavy, and similar blends.

The Price Ripple

A gap of 3 million barrels a day—close to the combined heavy exports of Iran and much of Venezuela—would squeeze the market. OPEC keeps formal cuts of 1.65 million barrels a day in place through 2025, and most spare capacity sits in lighter grades. Extra Chinese bids would narrow or even reverse the usual discount that heavy crude carries to light benchmarks such as Brent. Citigroup warns that a brief disruption can push Brent above 90 dollars per barrel, and any sustained loss would drive it higher.

U.S. refiners would feel the pinch first. Their coking units rely on heavy feedstock, and retrofitting plants for light shale crude would cost hundreds of billions and take decades.

What Traders and Policymakers Should Watch

- Signs that the Supreme National Security Council endorses the Hormuz vote.

- Spot price differentials for heavy grades versus Brent.

- Chinese crude draw rates and chartering activity out of key Gulf ports.

- Gulf Coast refinery run cuts or emergency cargo bookings.

- U.S. moves to ease Canadian tariff pressure or open new import channels.

Final Thought

Oil security is not only about how much a country pumps. Barrel type, choke points, and stockpile depth matter just as much. Until refineries adapt or supply chains diversify, heavy crude from the Gulf will keep a tight grip on both market pricing and foreign policy.

References:

- U.S. Energy Information Administration, “Oil imports and exports,” 2023 update(1).

- EIA, “Refinery Capacity Report,” January 2024 tables(2).

- Reuters, “Iran oil doomsday in Hormuz may be more fear than reality,” 22 June 2025(3).

- SEC Form 10-K, Delek US Holdings, filed 26 February 2025 (refinery crude-slate details)(4).

- SEC Form 10-K, Marathon Petroleum Corp., filed 27 February 2025 (U.S. refinery network)(5).

- Columbia University SIPA, “China’s Oil Demand, Imports and Supply Security,” testimony 6 May 2025(6).

- Vortexa Insight, “China builds crude stock amidst turnaround peak,” 3 September 2024(7).

- Canadian Energy Centre, “The Importance of Canadian Crude Oil to Refineries in the U.S.,” fact sheet, February 2024(8).

- Geopolitical Futures, “Iranian Oil and Gas Infrastructure,” 20 June 2025(9).

- EIA “Today in Energy,” “U.S. crude oil production increases; imports remain strong,” 25 February 2020(10).