Overview: A New Tariff Landscape

On April 2, 2025, President Donald Trump unveiled his “Liberation Day” tariff plan, a bold escalation of U.S. trade policy.

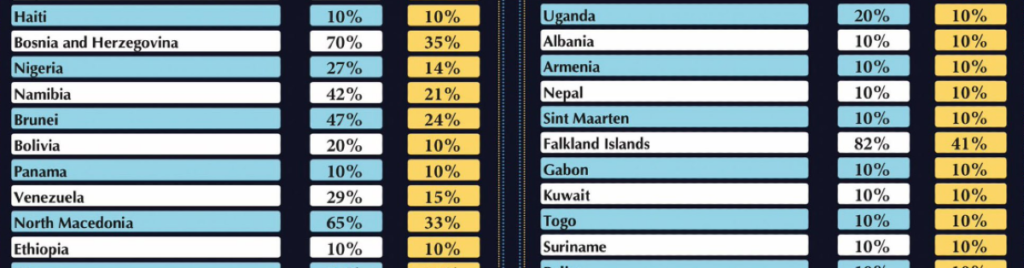

Effective April 5, a 10% baseline tariff hits all imports, while reciprocal tariffs—calculated as half of what over 180 countries allegedly impose on U.S. exports—kick in on April 9, with rates soaring as high as 49% for nations like Cambodia.

Layered atop pre-existing tariffs (e.g., 20% on China, 25% on Canadian steel), this move aims to rebalance trade, boost domestic jobs, and flex American economic muscle.

But as markets reel—U.S. index futures dropped 0.6% to 2.5% after-hours on April 2—and trading partners brace for impact, the cure might prove more disruptive than the disease, especially for emerging and third-world countries caught in the crossfire.

Trade Imbalances: The U.S. vs. the World

The U.S. has long run a trade deficit, importing far more than it exports—$947 billion in 2024 alone, per the U.S. Census Bureau.

China tops the list ($279 billion deficit), followed by Mexico ($152 billion), Vietnam ($105 billion), and the EU ($184 billion). These imbalances stem from a mix of factors: cheap labor abroad, U.S. consumer demand, and foreign tariffs or subsidies that tilt the playing field.

Vietnam, for instance, slaps 20-30% tariffs on U.S. machinery; India’s duties on tech goods hit 25%; and the EU’s agricultural barriers keep American farmers at bay.

Meanwhile, the U.S. has kept its average tariff low—around 2.5% pre-2025—making it a magnet for exports.

Emerging economies lean heavily on this dynamic.

Exports to the U.S. account for 20-40% of GDP in places like Vietnam and Mexico, fueling factories, jobs, and growth. Their high tariffs on U.S. goods—often 15-50%—aren’t just protectionism; they’re existential, funding budgets in countries where tax bases are thin. The U.S., with its massive market (22% of global GDP), has been their golden goose. Trump’s tariffs aim to flip this script, clawing back revenue and jobs. But the fallout could destabilize far more than it restores.

The Double Whammy for Emerging Economies

For emerging and third-world countries, these tariffs are a gut punch with two fists:

- Export Collapse and Investment Flight

The 10% baseline, plus reciprocal rates (e.g., 46% for Vietnam, 36% for Thailand), makes their goods uncompetitive in the U.S. A Cambodian shirt or Mexican auto part now costs 20-60% more, driving buyers to domestic or rival sources. Factories built on cheap labor—think Nike in Vietnam or Foxconn in India—face closures or shrinkage as foreign investment dries up. Mexico’s manufacturing PMI, already at 46.5 in March 2025, signals the bleeding’s begun; Vietnam’s could follow, with exports (40% of GDP) in freefall. Supply chains collapse too—local suppliers, energy providers, and logistics firms all lose out. - Budget Crises and Social Unrest

High tariffs on U.S. goods are a lifeline for these governments, funding subsidies that keep food and fuel affordable. India’s 25% duties on tech, Cambodia’s 30% on machinery—these aren’t luxuries; they’re survival. Cutting them to dodge U.S. retaliation slashes revenue; keeping them invites harsher reciprocal tariffs, cratering exports. Either way, budgets implode—some estimate 20-30% revenue losses in fragile states. No cash means no safety nets, and with factory jobs vanishing, unrest looms. Sri Lanka’s 2022 riots over fuel shortages could be a preview—multiply that across dozens of nations.

Adjusting Tariffs: A Fix That Fails

These countries can’t just tweak their way out. Lowering tariffs on U.S. goods floods their markets, killing local industries, and still doesn’t restore U.S. access fast enough—short-term pain with no gain. Long term, pivoting to China or Europe (OECD growth at 3.1% for 2025) takes decades they don’t have, especially as protectionism spreads (Europe’s eyeing 20% on U.S. goods). Their GDP could shrink 5-10% in a year—Mexico’s already at -1.3% per OECD projections, pre-full tariff hit. It’s a trap: damned if they adjust, damned if they don’t.

Unexpected Consequences: A Global Backfire

Trump’s fix might spark outcomes no one bargained for:

- Supply Chain Chaos: U.S. firms reliant on cheap imports—think semiconductors from Taiwan (42% total tariff) or auto parts from Mexico—face shortages and price hikes. Inflation, not jobs, could surge.

- Retaliation Spiral: China’s hinted at rare earth export bans; the EU’s mulling tariffs. A global trade war shrinks markets for everyone, U.S. included.

- Dollar Pressure: As export economies falter, demand for dollars (to pay U.S. suppliers) drops, potentially weakening the dollar’s reserve status—a slow burn Trump might not see coming.

- Unrest Spillover: Social chaos in places like Cambodia or India doesn’t stay local—refugee flows, extremism, or regional conflicts could hit U.S. shores indirectly.

Conclusion: A Risky Bet

Trump’s tariffs aim to right trade wrongs, but the collateral damage could outweigh the gains.

Emerging economies face an existential squeeze—export losses and budget crises that fuel unrest—while the U.S. risks supply shocks and a boomerang of retaliation. It’s a high-stakes gamble: protect American workers, yes, but at the cost of global stability?

The fix might break more than it heals, and the world’s weakest players will pay the steepest price.

Can they band together to push back, or is survival mode the only play left?